Lenders in the Philippines offer different types of personal loans to potential borrowers who need immediate cash to fund an important expense. These loans cater to different needs and financial capabilities.

If you’re looking for personal loans in the Philippines, there are usually several options to choose from. Your credit rating, age, income and financial history will define which type is potentially the best for you and lenders will generally offer you a couple of options, depending on what you are using the loan for.

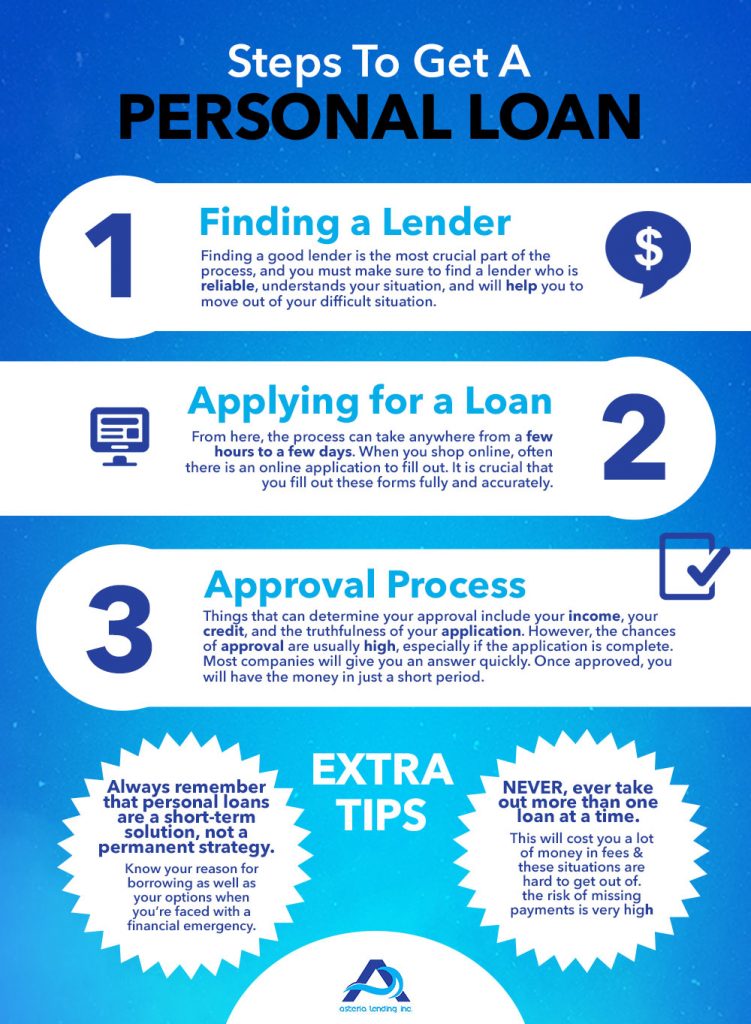

Never make the mistake of applying for a personal loan online without researching and understanding the various choices available for consumers. Find out what personal loans will work for you and eliminate the ones that do not fit your needs.

It’s essential to make sure you understand the kind of loan you are looking and to check that what you are applying for is suitable for your needs. Though it may surprise you to hear this, some people, especially those who need cash quickly, can apply without reading all the information. This inevitably causes problems further down the line.

The Characteristics of Loans in the Philippines?

Fixed Term

This relates to the length of time you will take to pay off your loan. As a rule, regular monthly payments will need to be made over an agreed period. Common “terms” are usually between 12 and 36 months. Loans that take longer to pay off are generally more expensive due to having a higher interest rate.

Set Loan amount

Most loans in the Philippines are between 10000 and 2 million php. How much you can potentially get will vary depending on your income and credit history.

Fixed interest rates

Variable interest loans are very rare. Most loans in the Philippines generally come with a fixed interest rate that lasts for the full length of the term you agreed to. The only time you may end up paying more interest is if you miss payments and incur penalties from your lenders.

What can loans be used for?

People in the Philippines use loans for all kinds of reasons but some of the main ones are travel and vehicle costs, repairs and improvements to homes and gardens, holidays and debt consolidation. Loans shouldn’t really be used as a source of every day income unless you are certain you can pay back the money in the future but for larger purchases that may be beyond the reach of your current pay check, they can help you to afford some of life’s more expensive essentials.

Secured vs Unsecured Loans.

Secured

This type of loan requires you to own something of significant value that can be used as collateral against the amount you are borrowing. Generally reserved for higher amounts money, this type of loan is often used for large, one off purchase such as houses, land or business-related property. As secured loans are considered a higher risk, borrowers will need a healthy credit rating to be accepted and interests’ rates will vary depending on factors such as current and past employment. The lender can take possession of this item you have used as collateral if you fail to meet payments. This means homes and vehicles can be at risk, so only consider this option if you are in position to make regular payments comfortably.

Unsecured

Loans that do not involve any form of collateral are lower risk as you do not need to prove ownership of any high value items. Unsecured personal loans are more common than secured loans in the Philippines and can obtained from several different banks and providers. There are also government issued multipurpose loans available, which offer different rates and amounts depending on the circumstance. For unsecured personal loans in the Philippines interest rates can vary between 25% and 54% and are usually available in amounts of up to php 1 million.

For consumers, unsecured loans are a much lower risk arrangement than secured personal loans as they do not put your property at risk. For lenders, they are considered a much higher risk, so if you are applying for this type of loan in the Philippines, you will need to ensure that you can provide evidence of responsible borrowing, steady income and a good credit history.

How to find the best loan provider in the Philippines

Always look around and compare interest rates as well as the terms and conditions that come with the loan you are considering. It can be tempting to accept the first provider you find for the sake of speed and convenience, but just as you would elsewhere, take some time to shop around to make sure you get the best value.

Who can apply?

Unless you have a poor credit rating or have outstanding financial penalties, most people will be eligible to apply for a loan, though rates and terms can vary significantly, depending personal circumstances.

Which type of loan is right for me?

This will depend on what you need it for, most of all. For property, cars, land or other very large purchases, secured personal loans are often a good option for those in a financially stable situation. For smaller items, debt consolidation or study costs, unsecured personal loans are usually a better option. Ultimately, you will need to be realistic about your financial situation and be wary of taking on more than you can afford. When deciding which type of loan is right for you, consider how much the repayments will impact on your overall budget before you make a final decision. You will need to ensure you can still afford to pay for essentials such as rent or mortgage payments, food and health costs after you have accounted for the amount you need to pay each month. Be aware of any additional charges for late payment, too, as this can make your overall payments much more expensive.